Global Slowdown, Nigeria’s Policy Shift Hit Katsina Markets

By Zaharaddeen Ishaq Abubakar | Katsina Times Business Desk

The global economy is entering a fragile phase, as rising tariffs, inflationary pressures, and political instability slow growth across markets. From the world’s major economies to Nigeria, and down to local grain markets in Katsina State, the ripple effects are being felt directly.

The Organisation for Economic Co-operation and Development (OECD) projects global growth at 3.2% in 2025, dropping to 2.9% in 2026 — one of the weakest periods since the 1960s. The United States’ near-20% tariff hikes are tightening trade, while central banks battle inflation and sovereign debt.

The World Economic Forum (WEF) also warns that disrupted trade flows, emerging technologies, and political unrest could destabilise growth in developing economies.

Africa’s Uneven Path

Across Africa, commodity-dependent economies face pressure from volatile global prices and weaker foreign investment. Debt burdens and weak infrastructure continue to restrict growth. However, some countries are moving to diversify by processing raw materials locally and building stronger regional trade links.

Nigeria’s Monetary Turn

In Nigeria, the Central Bank cut its benchmark interest rate by 0.5 percentage points to 27% the first reduction since 2020. This followed five consecutive months of falling inflation, measured at 20.12% in August. Governor Olayemi Cardoso signalled further cuts if the trend continues.

The Bank also lowered commercial banks’ cash reserve ratio from 50% to 45%, aiming to release more credit into the economy. Economists view the shift as relief for small businesses, farmers, and traders, though foreign debt, oil dependence, and currency challenges remain risks.

Katsina’s Markets Under Strain

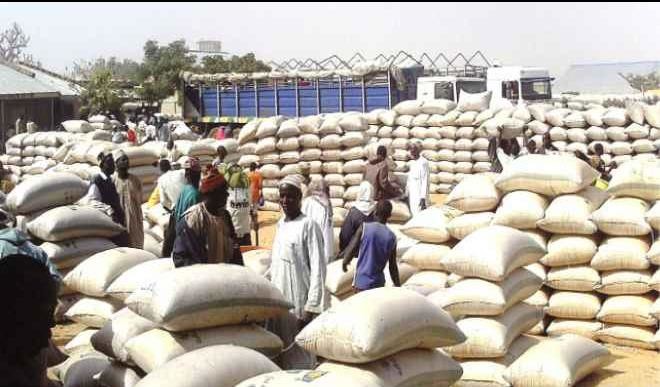

In Katsina, the Dandume grain market the state’s largest hub illustrates how these policies filter into daily life. Farmers and traders deal in maize, millet, rice, and sorghum, alongside livestock trade, despite security challenges.

Though inflation has eased nationally, high transport costs, fuel prices, and insecurity continue to push local food prices higher. Easier access to credit could help traders and farmers, but scepticism remains over whether banks will extend loans to small-scale businesses.

Banditry and cattle rustling disrupt farming and transport, forcing many farmers to scale back cultivation. The result is lower yields and higher food costs. Experts say Katsina could turn the situation around with investment in agro-processing, storage facilities, and cooperative structures to reduce post-harvest losses and increase value addition.

Hardship Persists for Families

Despite inflation cooling, many households in Katsina still struggle with food insecurity and poverty, often prioritising daily meals over long-term needs. Traders remain cautious, adjusting prices amid market uncertainty.

The global economy is shifting, and Nigeria has begun easing monetary policy after years of tight control. For Katsina, the key challenge lies in whether these changes can be translated into real relief in its markets. Addressing insecurity, boosting access to finance, and building agro-industries could help turn today’s risks into opportunities.

For now, farmers and traders in Katsina continue to navigate a difficult environment, waiting to see if government policies and investor interest will deliver meaningful change.